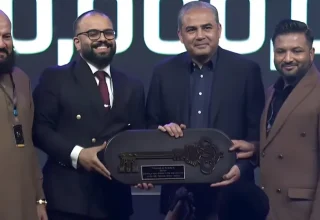

Federal Minister for Finance and Revenue Senator Muhammad Aurangzeb on Monday participated in a high-level roundtable titled “Addressing Sovereign Debt Vulnerabilities” at the AlUla Conference for Emerging Market Economies 2026, jointly organized by the Government of Saudi Arabia and the International Monetary Fund.

In his intervention, the finance minister said that global public debt remains at historic highs, placing sustained pressure on emerging and developing economies through elevated debt-servicing costs, tighter financing conditions and constrained fiscal space. He emphasized that the central policy challenge is not only managing debt stocks but also preventing liquidity pressures from escalating into solvency crises while safeguarding growth-enhancing and social expenditures.

Senator Aurangzeb referred to remarks by Saudi Arabia’s Minister of Finance Mohammed AlJadaan, who observed that macroeconomic stability is not the enemy of growth but a necessary foundation for sustainable and durable economic expansion. He said Pakistan’s recent experience strongly reinforces this assessment.

The finance minister said Pakistan has made initial but meaningful progress in restoring stability through disciplined macroeconomic policies, institutional reforms and proactive debt management, while acknowledging that the reform journey remains ongoing.

He said Pakistan has remained on track to contain and better manage public debt by extending maturities, reducing servicing costs and undertaking early debt repayments.

These measures have contributed to a decline in the debt-to-GDP ratio to around 70 percent from about 74 percent over the past three years, while the external debt-to-GDP ratio has remained broadly stable, alongside tangible interest cost savings and reduced refinancing risks.

Senator Aurangzeb also highlighted Pakistan’s institutionalization of regular and transparent debt sustainability analysis aligned with IMF-World Bank methodologies, covering domestic and external debt as well as government guarantees. He said this approach has strengthened risk identification, improved engagement with creditors and supported market confidence, in line with the objectives of the G20 Common Framework.

He further highlighted progress in domestic resource mobilization, noting that Pakistan has raised its tax-to-GDP ratio to around 12 percent from single-digit levels in earlier years, supported by tax reforms, digitization and base-broadening measures.

The finance minister also drew attention to Pakistan’s efforts to align debt management with climate and development objectives, including the issuance of a Green Sukuk and the establishment of a Sovereign Sustainable Financing Framework.

Concluding his remarks, Senator Aurangzeb said addressing sovereign debt vulnerabilities requires early action, strong institutions, transparency and credible policy frameworks, supported by enhanced global coordination. He stressed that stronger creditor cooperation, effective liability management operations and the integration of climate resilience into debt frameworks are essential for sustainable debt management while preserving growth and development priorities.